How much can I afford?

Most buyers set a target price without doing any homework. Since Silicon Valley homes are so expensive, most buyers will not be happy with homes at their initial target price and want to spend more. Your assignment is to determine the maximum you can afford and then scale back from there. The two key factors are how much you have available for a down payment and how large of a loan do you qualify for.

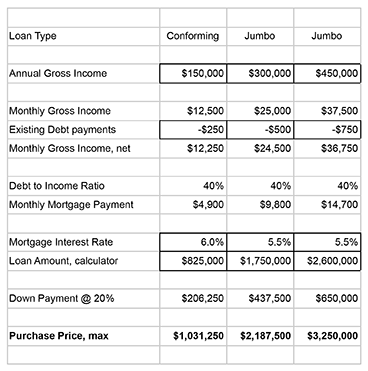

Down Payment – most purchases are with at least 20% down because less than that adds expensive mortgage insurance to the monthly payment. To calculate, take the amount of funds available for a down payment and divide by 0.2. You probably will do this several times depending on different levels of investments you are willing to liquidate for the purchase.

Debt-to-Income (DTI) ratio – Lenders sets a maximum amount of gross monthly income to pay all debts, including credit cards, car payments, student loans, etc. Over 40% is considered high with the mid-30%’s more typical. The mortgage related expenses include the monthly mortgage payment (principle and interest), property taxes, home insurance and HOA fees. Property taxes are usually ~1.2% per year of the purchase price. Home insurance is usually in the $100-$200 per month range. HOA fees, if any, are in the $400-$500 range. Do the math to determine the maximum mortgage payment that you might qualify for. Most buyers don’t want this high percentage of monthly income going to mortgage payments. Rocket Mortgage provides a nice comprehensive explanation.

Interest Rate – the higher the rate, the higher interest payment, which lowers the principle payment, which reduces the size of the loan. Rates vary depending on type of loan (fixed vs adjustable), credit score (700-740 is typical), The rate used by most online calculators is around 6.5%, the current national average. A related post at SiliconValleyMLS.com/interest-rates shows that 5.5% is probably more likely in your situation.

Loan Amount – now use one of the online mortgage calculators to back-into the monthly payment that fits within your DTI calculation.

Examples – three examples with annual Gross Incomes of $150,000, $300,000 and $450,000. Note the conforming loan has a higher interest rate.

Recommendation – talk to a mortgage advisor. They are free and easy to talk to. Go to your existing bank to do a first pass. They will review your credit scores and identify any issues/challenges, such as no enough credit lines or work history. They can also explain the options such as fixed vs adjustable loans and discounts for customers. There is no obligation, so you can talk to other lenders as you get closer to your purchase. You will at least know your maximum purchase price and adjust to a level that you can sleep with.