Silicon Valley Real Estate

January 2026

The following charts show averages for single family residences across 12 Silicon Valley cities from Menlo Park to Los Gatos. The Our Homes button above shows data for the individual cities. The data is from MLSListings the multiple listing service for Silicon Valley.

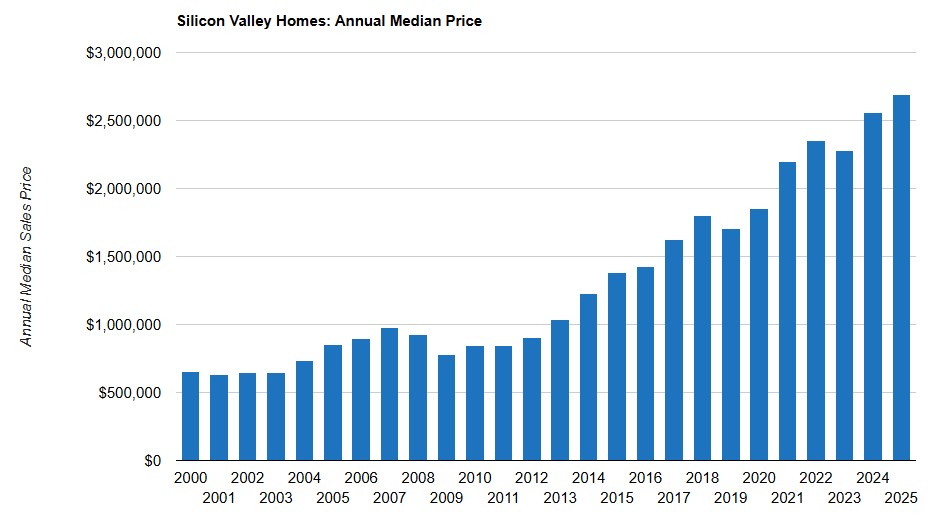

The Annual Median Price rose by 5.1% during 2025, following a 12% rise during 2024 and a dip in 2023. That’s an average appreciation rate of 8.8% since 2012 and 5.6% since 2000, which includes a global financial crisis and pandemic.

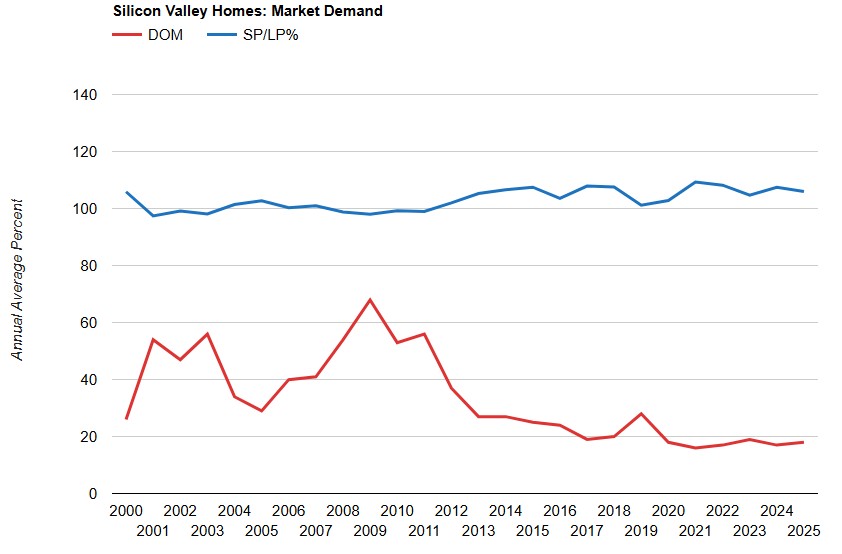

Market demand continues to be at historically high levels. Homes to sell quickly, even compared to our previous “hot” market. The average final sale price is over list and has returned to historically high levels. New listings selling within the first 14 days on market typically sell for well above the average (see charts on the city pages).

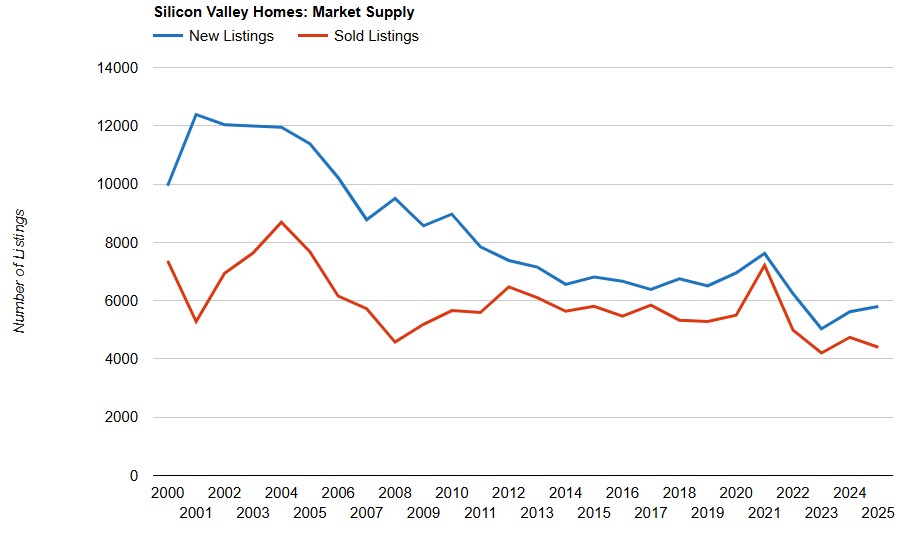

The supply of New Listings continues to rebound after 2023 with a 3% increase in 2025 following a 16% increase during 2024.

A solid investment compared to the typical stock/bond investment portfolio, especially when you include the up to $500,000 capital gain exclusion from federal and state income taxes.

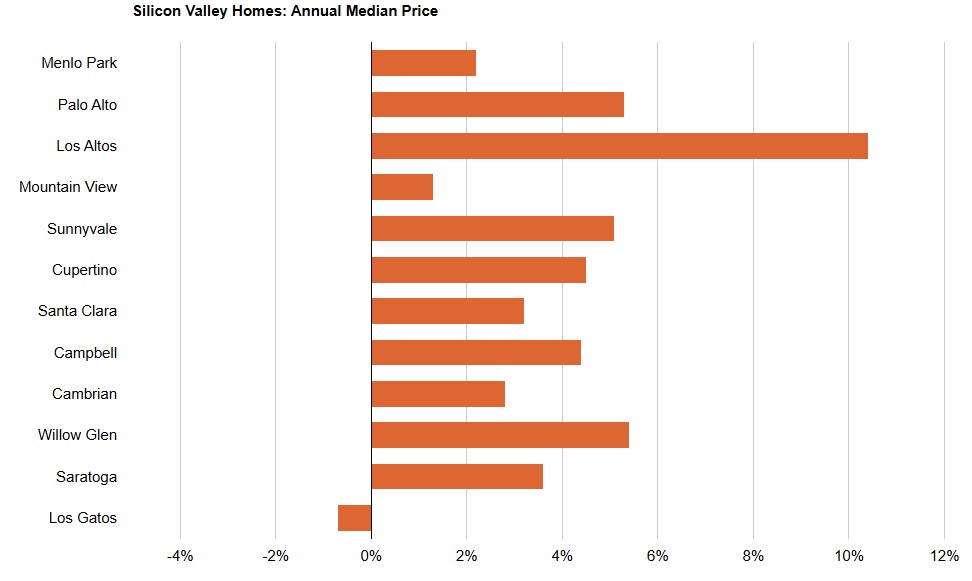

Appreciation has been strong across most of the individual cities.

Single family residences in Silicon Valley start at $1.0M. The good news is that there are a lot of homes in the $1.0M to $1.5M price range, predominately in Santa Clara, Campbell, Cambrian and Willow Glen areas of San Jose. There are homes under $1.0M outside of the 12 cities that I include in Silicon Valley: Redwood City to the north and south/east San Jose. The Our Homes pages show the distribution of prices for each city.

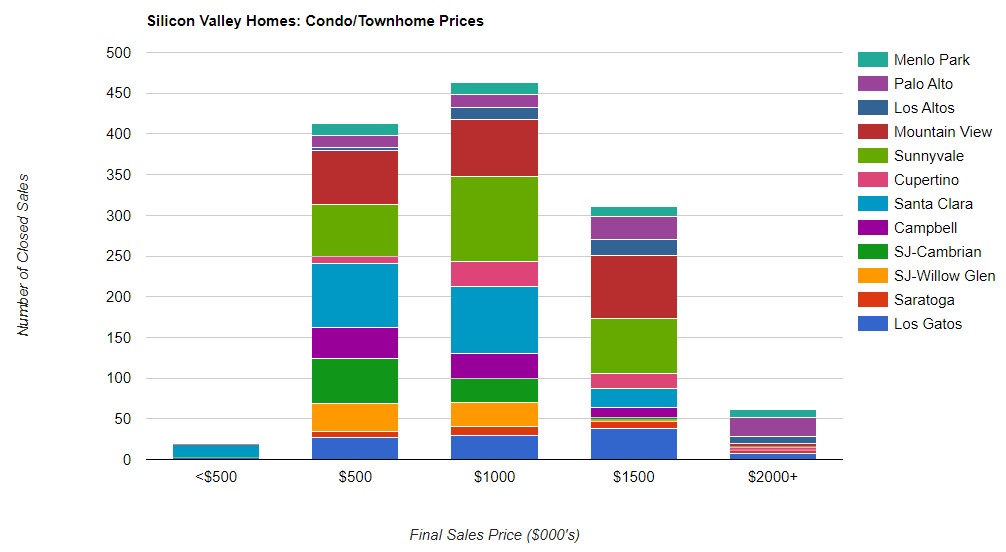

Condos and Townhomes start at $500K. The majority of Condos/THs are two-bedroom units with next most popular being three-bedroom units followed by one-bedroom units. Townhomes are typically more expensive as there is usually no one above or below you. End-units are at a premium as they have fewer shared common walls.

This website is dedicated to providing you with insightful and accurate information on the residential real estate market in Silicon Valley. The data is obtained directly from our local multiple listing service (MLS), which is used by virtually all Realtors in the area. This information is deemed to be accurate, however is not guaranteed.

Our Schools

Complete guide to schools, ratings and attendance boundaries. Most Silicon Valley cities have multiple school districts with individual schools with varying academic performance. Ratings are provided by GreatSchools.net along with the California Academic Performance Index (API).

Our Communities

A great overview of how Silicon Valley communities differ and their various features: restaurants, shopping, transportation and more.

The market data comes from MLSlistings the primary Multiple Listing Service (MLS) serving Santa Clara and San Mateo counties. The information is deemed to be accurate, however is not guaranteed.

Bryan Sweeley, MBA

Compass, Broker Associate, DRE# 01877044

Mobile: 650-793-0355

Email: bryan.sweeley@compass.com

Web: bryansweeley.com