Homeownership is considered to be one of the great wealth creators available, second only to stock options. The math below shows that owning a home can create close to $1M in personal wealth over 10 years!

Monthly Cost of Home Ownership vs. Renting

Many people think that they can’t afford the monthly payments. Let’s calculate the cost of owning a $1M home over 10 years. (you can scale up/down from there and I would be happy to run-the-numbers for your specific situation).

The monthly mortgage payment for a $1M purchase would be around $3,400 per month (at 3% interest with 20% down). Property taxes would be ~$1,100 per month for a total of $4,400 per month. The mortgage payment amount is locked-in for 30 years (no increases) and property taxes are limited to 2% increase per year (Prop 13).

First, the principal portion of the mortgage payment is savings, not an expense. Over the course of 10 years you reduce the outstanding loan balance by nearly $200,000! Increasing your home equity from the original $200,000 down payment to $400,000 after principal payments. This is before adding-in the compounding effects of appreciation.

The average cost of housing, excluding savings/principal reduction, over ten years is $3,000 per month. This consists of $218,000 in interest, $130,000 in property taxes (includes 2% increase/yr), and $12,000 in on-going maintenance ($1,200/yr).

This is reduced by ~$1,000 per month due to interest and property taxes being tax-deductible. Assuming a federal rate of 25% and a state rate of 8%, you would be reducing your annual tax bill by $11,500 per year, on average.

The average monthly cost of owning a $1M home is around $2,000 per month. The rental rate for a $1M home is in the $3,000 to $3,500 per month range. This suggests that owning a home is less expensive than renting by nearly $1,000 per month or $12,000 per year in this example.

What price home would equal your after-tax cost for housing? Reply to this email with a number for your current monthly rent amount and I’ll send you the above spreadsheet with your numbers.

Return on Investment

What is the return on an investment for a $200,000 down payment?

The median price for Silicon Valley homes has increased 6% per year over the past 20 years. This includes the Internet-bubble burst, the Great Recession and a global pandemic. With the power of compounding, it is reasonable to assume that our $1M home will appreciate to $1.8M over ten years.

That’s a $800,000 increase, before tax. The after-tax gain will be $700,000. There is a huge tax incentive for home ownership of up to $500,000 exclusion (married filing jointly, $250,000 single) from the gain. Primary requirement is that it was your primary residence for 2 out of the last 5 years.

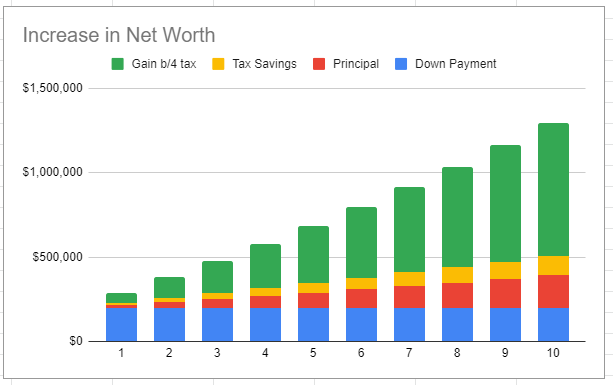

This adds-up to $1 Million in increased personal net worth. Nearly $200,000 in savings, over 10 years, from the principal portion of the monthly mortgage payment. Another $100,000+ in savings from reduced income taxes due to interest and property taxes deductions. And $700,000 in after-tax gain in appreciation. Remember that this is with monthly rent being roughly equal to the monthly cost of homeownership (interest plus property tax and maintenance.

This is why home ownership is better financially over renting. A pretty compelling case. Interest rates are so low that is certainly worth running the numbers.

Think it over. Send me an email and I’ll run the number for you and explore the options.

Bryan Sweeley

Broker Associate, MBA

Compass, DRE 01877044

Bryan.Sweeley@compass.com