January 2024

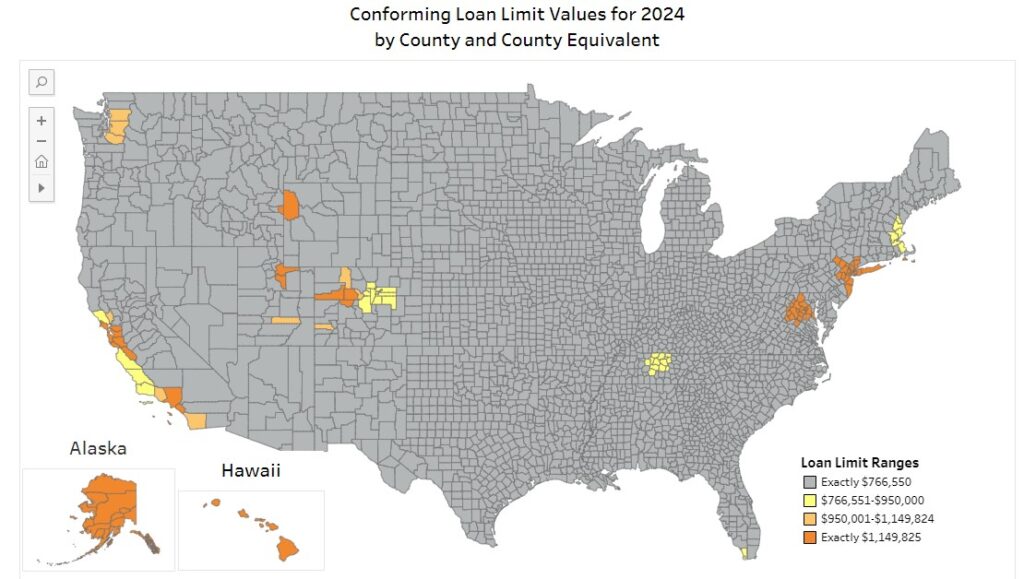

The Federal Housing Finance Agency increased the conforming loan limit to $1,149,825 in Santa Clara and San Mateo counties for 2024. A purchase price of up to $1.4M should qualify for a conforming loan, assuming 20% down payment.

Interest rates for “conforming” loans are currently higher than “jumbo” loans. Wells Fargo is showing 30-year fixed rates of 6.375% for Jumbo loans vs. 6.250% for Conforming loans. Not sure why the difference in rates, but one explanation might be that conforming loans are typically sold by the lender to the securities market which requires more effort to comply with security regulations.

Note that the current PMMS Mortgage Market Survey is saying that 6.66% is the national average for 30-year fixed rate mortgages. That is .3 points higher than what Wells Fargo is advertising.