October 2025

Interest rates vary fairly significantly. The biggest factors being whether the loan amount is conforming or jumbo and if the size of the down payment. Understanding what the rate is for your situation is critical in determining your target purchase price. Below are examples to help understand the financing market. I highly recommend talking to a lender to have them explain your options and run the numbers.

The financial news usually uses the Feddie Mac PMMS Mortgage Market Survey that shows the national weekly average. The average as of June 12th is 6.84% for a 30-year Fixed Rate Mortgage (FRM). . Economist with the California Association of Realtors forecasts that rates will decline by a point during 2025 and level-out a point lower in the following year.

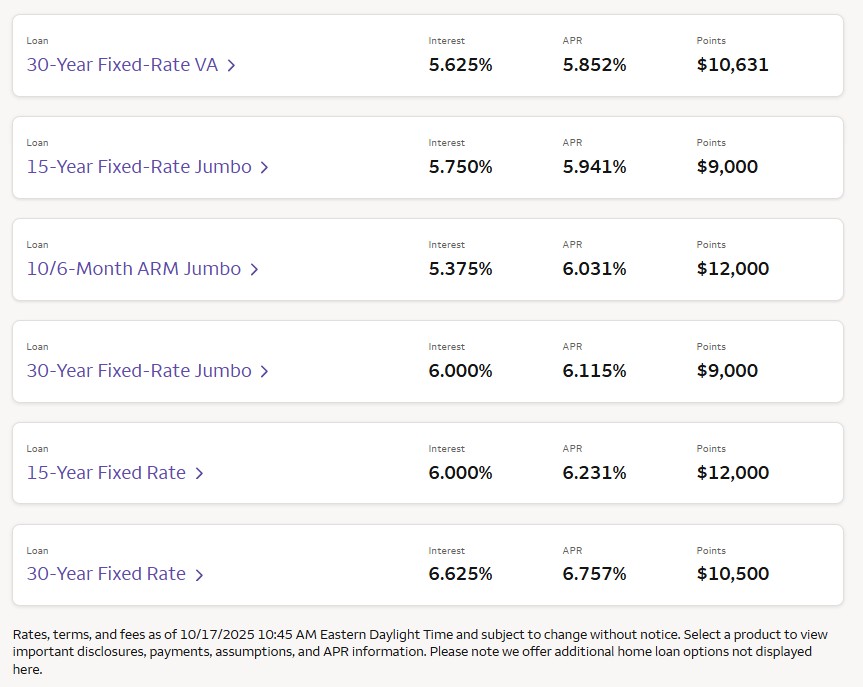

The Wells Fargo shows how rates vary significantly depending on whether the loan amount is “conforming” or “jumbo”. Most Silicon Valley homes are jumbo loans with the rate at 6.75% (and a little lower if you bank there). Note that a 7-year Adjustable Rate Mortgage (ARM) is significantly lower, which is an attractive option if you plan on refinancing after rates come down.

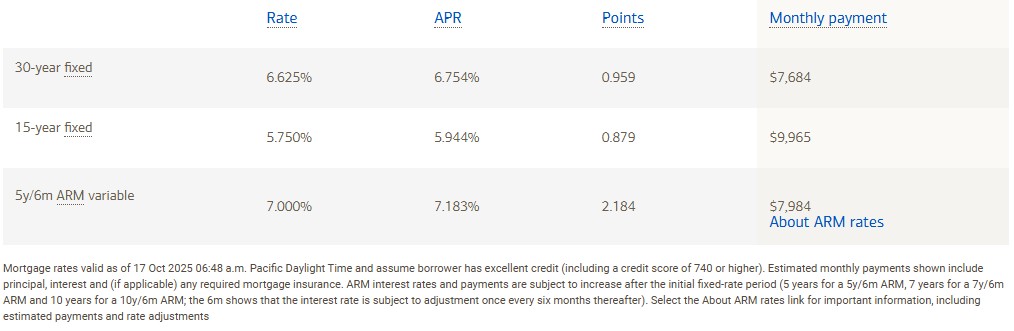

Bank of America shows that 25% down payment provides even lower rate. BofA’s jumbo rate is the same as Wells Fargo above. However their website shows the advantage of 25% down loan where the rate is 5.25% vs 5.375% for a 20% down jumbo loan.

Rates also vary depending on your credit score. Wells Fargo considers 760+ as excellent and 700-759 as good. Not clear what credit score the above rates are based on. I suspect a good score with an excellent score reducing the rate by 0.175 to 0.25 points.

Talking to one of the lender’s mortgage advisors is a great way and no-charge way to make a first pass at this. I recommend clients to check with their existing bank to have them explain the different loan programs and their rates. More importantly, they can run the numbers to determine how much of a loan you would qualify for.

My final recommendation is to not let high interest rates discourage you from investigating a home purchase. Most buyers can take advantage of a 7-year adjustable rate and then refi in 2-3 years as rates return to normal. The main negative impact of higher rates is that they reduce the loan amount you qualify for.